THE MARKET IN 2018

Here’s our forecast for Brisbane’s quality residential property market for the rest of 2018 & beyond.

As with previous annual forecasts, we start with a quick revision on how the market performed the previous year.

2017 – THE YEAR THAT WAS – A Tale Of Two Markets

If there was one disappointment for the market in 2017 it was it performed pretty much as we predicted it would.

The bottom continued its inexorable rise, the top slipped further, and the middle milled around not sure what to do.

The opportunists (pariah agents overly included) had a field day in the pain at the top end; caned just as severely but more understandably at the other end of the price spectrum were investment apartment owners caught up in the biblical like flood of new product; the state economy continued to do little or less but was returned regardless; banks got greedier, more fearful and cautious; Chinese investors stayed away in more droves fearing aggravated retribution here and at home; money stayed cheap officially but dearer and harder to get in reality; and the broad bottom lead recovery from the 2011 nadir in the riverfront market gathered further welcome pace.

There were the odd surprise in the market as is to be expected in any year in a democracy. Principal among those; Melbourne hung tough; Perth’s long plunging property fortunes paused (as commodity prices unexpectedly firmed – oil too); APRA stayed its hand; and the overdue seasonal buyer great migration north milled but didn’t move much (as they got to wondering if their markets had fully topped out after all – which as we now know for sure, they had).

Beyond that, the year was disappointingly predictable.

The government took further punitive (taxes) action to cool the property markets of the cities with the most votes making it patently clear to the Chinese particularly in the process that they were no longer welcome now that their buying up our property was such a political football (it was absolutely fine before that of course); the government also provided the usual lip service about levelling the banking playing field but didn’t do the one thing guaranteed to immediately achieve that, removing their (our) ‘temporary’ guarantee on deposits which would compel them to compete on a level playing field and immediately drive down their lending rates to where they should be given the current benchmark rate; and investment apartment developers and investors continued to deny the undeniable as they prayed for an unlikely miracle (while taking turns to stick large pins in to APRA and Jo Hockey voodoo dolls).

Less property direct but still relevant, Bitcoin became the new pyramid investment scheme of fancy (right up there with last century’s ostrich craze[y] and the previous one’s tulip [seriously – when will we wake up and smell the tulips?]) making millions seemingly rich, and then genuinely poor; global sharemarkets continued to wallow in super cheap money as they will whilesover it still is; Trump didn’t implode; Theresa May neither despite the UK’s coming financial disembowelment with the passing of Brexit (which even the ostriches with their heads in the ground can see); and no surprise, North Korea didn’t blow Japan, South Korea or the US (or itself) off the face of the planet.

In summary from a residential property perspective it was a year of some ups and some downs but overall a probable zero sum game. There was however a solid sprint for the finish line towards the end of the year which some welcome foundation for the market to perform in 2018.

THE MARKET IN 2018

Short of another APRA brain smash of the like that steered the current investment property train wreck or a bomb going off somewhere (ex-Pyongyang?), we can look forward to the quality end of the Brisbane market having a better year than last, and were we to keep the politics out of it, perhaps even a much better one.

Looking at some key fundamentals:

INTEREST RATES – As there are no underlying inflationary pressures to give the RBA any true cause to lift official interest rates, not even pre-emptively (though watch APRA’s itchy trigger finger there, all that power in inexperienced hands could again blow up in our faces), don’t fret on that score

DEMAND – Though the cyclical great northern migration has hardly raised a spec of dust this time around yet, if history is any judge, it must soon. The only thing that can stop it is if southern property prices were to retrace their recent gains. That has never happened in history and there’s no reason for it to this time

SUPPLY – There are far fewer $1million plus houses (but not apartments) on the market today than a year ago. Listings at the entry $2million market for the river are also well down on this time last year or in other recent years

SENTIMENT – Whilst the state may still be missing ‘CanDo’ Campbells ability to get things done but not as much the manner in which he did, even at the much slower economic pace that has become our lot these past few years, there is today a more positive undercurrent emerging that things could be turning. That wasn’t there a year ago

ECONOMIC – State royalties have started rolling in nicely again and assuming they are not squandered for political ends should give our state a big lift. Tourism is also firing nicely and so too the rural sector.

TAILWINDS for the market this year will include the now record attractiveness of our house prices compared to the southern capitals that traditionally feed our market and still historically very cheap benchmark interest rates.

HEADWINDS will be banks increasingly hawkish view on property, particularly apartments (the latter unsurprising) but also for Brisbane housing (where it is unwarranted); APRA’s hogtying of the market; and in the same vein, our government colluding with the Chinese on to make it near impossible for anyone but insiders (Chinese untouchables – for today anyway) to get their money out of China to buy up more of our real estate and hold up the market.

CROSSWINDS for the market this year may include; Inflation (remember the word?) rising; southern markets cooling too much or too fast; Xi Xinping’s and Trump’s political posturings and repositionings going too far (Xi Xinping wants to be the new Mao and Trump to be respected); Europe’s winds of change now prevailingly from the east.

CURVE BALLS, always harder to predict but always to be expected could include: China’s economic ascent slowing faster than markets can adjust; the US long term descent stalling; the UK not taking laying down the rotten (and only) Brexit deal on offer (the EU can’t do otherwise because to do so would invite others to leave) - the oft voiced term ‘Orderly Brexit’ a new oxymoron right up there with airline food; and an early federal election here (but only if those currently in can get any part of their long snouts in front of the at least equally lengthy ones of those currently out).

GENERAL

The recent trend away from apartments towards landed property (accelerated further now the Chinese are realising apartments don’t do so will in Australia or other underpopulated countries) will gather even more momentum.

The rise of upwardly mobile satellite suburbs and provincial cities will also come more to the fore this year (and beyond) but for different reasons, their growth spurts driven by the strategic devolution of traditional retail in favour of Etail (I might patent that) which only requires a distribution warehouse rather than the shopfront in town, that will see business owners progressively choose to live handier and more economically (until prices catch up) to where their businesses will increasingly be.

Also to gather pace for the same reasons will be the conversion of non-viable or disused commercial and retail space to residential or other use (particularly the ubiquitous 60 and 70’s strip shops which after being badly wounded by the big shopping centres are being finished off by Etail.

We will not see the same numbers of Chinese in the market this year as previous ones as the combination of draconian purchasing disincentives (taxes) imposed on them by our governments state and federal (snouts in troughs) coupled with equally draconian limitations on them getting their (own) money out of China (to invest or even just to spend - passing quietly into law in China - not that they have a rule of law as such as we know - recently was no Chinese family is able to take out or spend overseas on any Chinese credit card (other than for a small number of approved purposes) more than $15,000 per annum. $15k a year won’t service a mortgage and would hardly cover most yearly university fees.

This latest tightening of the capital flight restrictions noose follows hot on the heels of another limiting to just $100 a day how much Chinese are able to spend abroad without their bank system lighting up to ask them what they are spending their money on. $100 a day for food, leisure activities, accommodation, car hire, and other expenses? Go figure! We suspect the amount of cash Chinese coming to this country bring is sure to skyrocket as a result.

How is that able to be policed given credit cards etc you may ask? By restricting Chinese to Chinese banks and Chinese bank credit cards. If a Chinese travelling tries to draw out or spend more than $100 in a given day, a prompt promptly appears asking them to explain why they are spending so much (yes, of their own) money.

Whilst this latest initiative to keep Chinese money safely in China won’t empty the Palazzo Versace because the very well connected have and play by different rules, it will greatly impact our mid range tourism accommodation.

The number of expats coming home for a well earned rest (temporary or permanent) in response to an outside world getting just so much harder to make a crust in will continue to grow this year. Fuelling this growth will again be the eTail phenomenon above (by the end of this missive I might be able to have it recognised as a new word for 2018’s official lexicon of new words) which Australia lags a long way behind others in embracing providing an opportunity for expats to jump in at close to ground floor.

This very same phenomenon should also ring in a revival of fortunes for some of our more geographically privileged provincial cities like Toowoomba and Armidale who enjoy great weather and aren’t too far away. Joining them will be communities along the coasts that will also get taken along for the same ride, particularly those in the section from Batemans Bay to Bundaberg (north of the need for year round woolies – and south of the killer stingers and crocs).

Before we had no choice but to go where the work was but eTail is changing all that. Increasingly we can go to where we want to be and take the work with us. It’s a brave and exciting new world. The global eTail evolution will change the property investment landscape forever and all things being equal make Australia an even luckier country.

As it continues to evolve as it inexorably will, if we can keep some of the politics out of it, we will again become the richest country on earth (this time more than just economically).

PROPERTY AROUND THE NATION

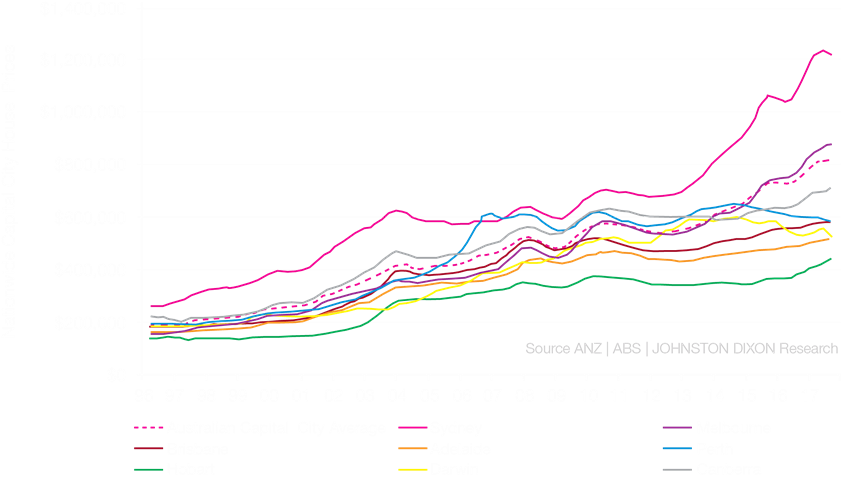

Nationwide the property price growth cycle continues on its inexorable way (with the usual usually economically and politically inspired bumps, lumps and humps). They say a picture tells a thousand words so here it one that really should (courtesy ANZ | ABS & US), Australian Capital City House Price Averages over the past 2 decades.

.

.

.

.

.

.

Starting at home (with or without the benefit of the graph), quality Brisbane housing is long overdue for a good year and will get that at least in part because the pent up pressure for that to happen is just so palpable.

In summary (in general order of significance) such pressures include:

Affordability – On top of record low interest rates, our property prices sit at all time record lows compared to our traditional key feeder capitals of Sydney (particularly) and Melbourne

Migration - People are once again heeding the primeval urge to head (north) for the sun (surf and sand), this much accelerated by the pricing graphic and point 1 above of course

Mining - The mining investment bust is done, prices are firming, and royalties are again filling hungry government coffers

Tourism – Record inbound tourist numbers are providing another economic fillip for the state

Agriculture – We are doing better because prices are better but also because we’re getting better, droughts and all

It won’t be all beer and skittles however. The investment apartment hangover from the greatest binge in history will continue to adversely impact markets including those not really related, a situation banks are making worse by (justifiably probably but regrettably nonetheless) greatly restricting lending for all apartment purchases.

Has Sydney finally peaked? Well, people in Sydney seem to think so, so it probably has. We did see further upside last year for our southern cousins where many others didn’t but now we agree it’s fully topped and that 2018 will largely be a period of consolidation (probably preceded by a normal reverse dead cat bounce – the market bouncing back a little off the ceiling as it tends to do when reaching a new peak).

What of the talk Sydney could be in for a hard landing? We don’t think so unless it comes to pass the Chinese rug being pulled out from the market means more for Sydney than anyone thought it would or was reported (which would be rare) to be. Sydney was long overdue for a good run in the market after doing nothing in the noughties so their recent good run should have been expected, the only area of doubt being did the Chinese buy in then drive it beyond what otherwise might have been its cyclical peak. We don’t think so but we could well be wrong. We’ll know soon enough either way.

Melbourne on the other hand as the most Chinese influenced capital in the country may be a very different story, and this despite it surprisingly hanging tough to the surprise of many in 2017.

Such has been the Chinese influence on the fortunes of the Melbourne market, that their retreat from it could leave quite a void and expose it to quite a hard landing.

So far the cracks in the Melbourne market only appear hairline but with the Chinese money that drove it so hard fast drying up and the Victorian government struggling to deal with it, the cracks could open up considerably and quickly. If a fear driven flight from the Melbourne market takes hold, history shows it would take some stopping.

Adelaide rails run from the Melbourne boom has run its race because Melbourne as its key feeder market has but unlike Melbourne, as a ‘God’s Waiting Room’ capital (a distinction it shares with Hobart and to a lesser degree us), the level of any correction in Melbourne near term will not be felt to the same extent in Adelaide.

Perth’s price decline has slowed courtesy a bounce in commodity prices that appears to be holding. Like Brisbane, any recovery in their market should it get to that this year or next will be a ‘bottom up, inside out’ affair (i.e. bottom of the market upwards, inner city outwards) but unlike Brisbane be almost totally reliant on the resources sector holding up.

Hobart as the retirement capital of the nation (seriously why else would you go there other than to die on a budget) with its core feeder markets of Sydney and Melbourne having peaked has just had its best year of capital growth in decades at 13% yoy, almost as much as all other capitals (that had positive growth) combined, an inference that should continue albeit at a lesser pace whilesover the numbers bailing out at or around the top of the market in Sydney and Melbourne to go elsewhere to live cheaper stays high.

Canberra as the seat of government and with neither of the two principal parties willing to countenance (let alone put into effect) any semblance of cuts to the bloated public service (no it’s not another oxymoron – don’t go there) has had a good year and will have another as it benefits from cashed up inbound public service or public service allied transfers from the big two capitals.

Darwin performed worse than expected last year (and we expected it to perform pretty badly) to be the worst performing capital city in the country by some margin but may fare less poorly this year given firming commodity prices. Being such a small marketplace, Darwin is always hard to call, all you can predict with any certainty is its unpredictability.

AROUND THE GLOBE (select countries of interest | relevance)

The global property picture continues to become increasingly opaque (or we are looking too much into it).

Sullying the global property investment landscape particularly at present is governments ‘infatuation’ with the commercially inept but politically popular practise of supertaxing overseas investors which governments can because OI’s are such soft targets (and don’t get a vote). The trend is mind-numbingly short-sighted because whilst it may provide an immediate term mini fiscal and political fillip for governments dumb enough to try it, the severity and duration of the economic fallout from the pernicious practise outweighs any short term bounty. Beyond foreign investors taking their money elsewhere to where its more welcome is the broader damage to the reputation of the countries that impose the penalties. Once a country gets on the nose, it can stay that way for some time.

Given the number of countries choosing to wet their snouts in this latest dirty trough, where previously overseas investors would put most store in the economic fundamentals of the country they were looking to invest in, today almost equally important has become the question as to how likely the governments present and prospective of the preferred investment destination countries might be to introduce supertaxation or similar of overseas investors or simply add more layers to existing taxes as London has done so successfully recently much to its great discredit.

The practises gained popularity in over-regulated Europe, France taking the lead as early as the 1980’s with its raft of external investor taxes and other disincentives (remember the crazy squatter rule) that so threw investors at the time that today some 30+ years on, the odeur still lingers rankly.

Across the channel the UK’s most recent 3% supertax on purchases and rents (over and above already exorbitant general property purchasing and ownership premiums) that only applies to foreign investors has seen overseas ownership of London property drop by nearly 2/3 from 25% to just 11% in just the last few years.

Across the Atlantic Canada has introduced its own brand of like lunacy, their’s aimed squarely at mainland Chinese investors (again for the votes and short term cash windfall – they don’t care about the longer term damage as they don’t expect to still be in government to have to deal with it) where in Vancouver foreign investors now have to pay an extra $150,000 per $million more than Canadians to buy the same property. Now that’s a supertax!

The ploy has ‘worked so well’ it has seen sales turnover there plummet by an unprecedented 38% in just one year with prices on track to follow. The Canadian Goose that was laying so many golden eggs has been so well cooked by Ottawa that the government is getting less revenue post implementation of the super tax (due to the vastly shrunken volume) that what it was getting prior. Yes that was always predictable but only if your IQ is superior to your shoe size.

As Einstein is quoted as quoting ‘Only two things are infinite, man’s stupidity and the universe, and I’m not so sure about the latter’

We of course are becoming just as guilty and for similar short-sighted imperatives. Indeed we may have been guiltier earlier than many others to set the example for them to follow. Incredibly (certainly to the younger set) stamp duty used to actually be stamp duty, i.e. a cost set to defray the cost of stamping documents.

In has today become such an addictive cash cow behemoth and governments so hooked on it, they have no hope of ever weaning themselves off it, this despite them all seeing clearly the harm the drug is doing.

Enough of the stupidity of government. Peering into the turbid, select global property market waters in alphabetical order,CANADA (particularly out west) will continue to pay for its recent punitive property tax grab stupidity this year and beyond, where ‘jingle mail’, the act of handing back the keys and walking away from property has already arrived as a consequence; CHINA’s recent capital flow restriction inspired in country price spurt will lose momentum this year and depending on how Xi Xingping’s decision to stay in power indefinitely play out, could well see it go into reverse; helped somewhat by Brexit, FRANCE as one of the more stable countries of the EU (which speaks volumes of the rest) should continue its recovery from the substantial property price falls of the first half of the decade, GERMANY as the country that gets the most out of the EU alliance will also likely fare best from Brexit which should see property prices at least hold if not firm, particularly in Frankfurt as favourite to replace London as Europe’s financial capital; HONG KONG given it is easier for the mainland Chinese to repatriate money there should get to enjoy a good year (unless things calm down in China politically which is not likely); INDIA’s 5 year flatline market will continue flat; JAPAN will have another solid year despite ZPG; NZ will this year pay a high price for it’s ill-conceived (moronic) ban on foreign investors; the PIIGS overall will underperform thanks largely to the 25% depreciation in the Pound, brits in the past being key buyers; SINGAPOREshould continue to come out of its half decade long slump; SOUTH AFRICA will continue its strategic decline with no light at the end of any tunnel anywhere; SWITZERLAND‘s safe haven status will continue to lure nervous investors, particularly those from elsewhere in Europe; to the south last year’s broad price falls in the UAE will probably continue or even gather pace in tandem with rising regional tensions; the UK no surprise faces a very tough year(s) ahead; and finally the US will continue its long road back from it’s Sub Prime, Bear Stearns et al inspired lost decade.

KEY MARKET INFLUENCES CRYSTAL BALL

THE GOOD

~ The RBA rightly chooses not to follow the US lead in raising our benchmark interest rate

~ A dollar that if we don’t raise rates will fall further against the USD to make our property and visiting here cheaper

~ Staying current levels of housing affordability will greatly benefit the coming cyclical migration north to Brisbane

THE BAD

~ A federal government continuing bound, gagged and seemingly on life support

~ APRA seeing fit to flex its unqualified muscles again in the property market

THE UGLY

~ The Trade War between China and the US we flagged as likely last year and now formally underway widening

~ Australia getting clobbered for taking one side or the other, for not taking sides, or for trying to be a double agent

THE UNKNOWN (or Good Luck – Bad Luck – Who Knows File)

~ EU and UK beyond Brexit

~ China and the yuan beyond Xi Xinping’s deification

~ The end game of global 0% Interest Rates + Low to Negative Birth Rates + Money Printing + Runaway Debt

THE HOPE FILE

~ The great buyer migration north happens soon (this year)

~ Company taxes come down to where we can again compete globally

THE HOPE NOT FILE

~ An early federal election called here at home

~ The great buyer migration north stalls again

~ Banks call in their loans on investment apartments

THE WHAT WON’T HAPPEN THIS YEAR FILE

~ Genuine inflation and corresponding need for interest rate rises in Australia

CURVE BALLS

Trump (still) | Russia (always) | Investment Apartment Market Implosion

EXECUTIVE LEASING:

Brisbane’s quality residential leasing sector will firm this year for both houses and for apartments, though less so for the latter given it will be a little held back by the negative flow-on effects of the massive price discounting developers had adopted lower down the market in order to try and find tenants for their many unsold or unsettled apartments.

Expected to rebound particularly well after a number of years in the woods is the corporate leasing sector given burgeoning demand from a renewed tourism boom and a recovering resources sector.

Not dissimilar to what is happening in the sales sector, we expect the recovery to be pushed from the bottom up (in price) and from the inside out (from the CBD).

In tandem with the nascent recovery in Brisbane’s higher end property prices we can also expect that there will be a diminished availability of stock at the upper end of the leasing market as those people who previously leased when they couldn’t sell are again tempted to sell, an inference we expect to be most poignant across houses.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

THE FINAL WORD

‘LET’S HOPE AUSTRALIA DOESN’T FALL OFF CHINA’s BACK’

Like it or not, we now ride squarely on China’s back.

We need China more than we need anyone else and sadly, much more than they need us, we being only a market of 25 million people and less than 1/3 the size of their largest trading partner which it may surprise many to know, is Europe, and not the US.

Where it was once England, then the US, then Japan, then Asia collectively we depended upon for our ongoing prosperity, it is now unequivocally China.

And our dependence is broadranging, indeed increasingly almost universal across the many key sectors of our economy. The Chinese are today either our number 1 or at least 2 or 3 customer for our resources, our agriculture, foodstuffs, beverages, tourism, and latterly of course, our landed property of all descriptions.

Which makes the times we live in all the more interesting.

Whether or not he is in reality a vindictive man, indeed we think he is not which is why he succeeded in business, Trump the politician is right now desperate to land some punches from his many airswings and given the political climate, he thinks China might be his best sparring partner, with its (not) recent military expansions in the South China Sea the reason to pick the fight. We say not recent because they have had bases in the disputed islands for nearly 40 years.

If in trying to improve his image at home he lands a solid blow against the Chinese abroad, just how we can avoid becoming TKO’ed in the mix is worth giving some thought to.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Wishing you all the best in 2018 and beyond

Best Regards,

In summary (in general order of significance) such pressures include:

Affordability – On top of record low interest rates, our property prices sit at all time record lows compared to our traditional key feeder capitals of Sydney (particularly) and Melbourne

Migration - People are once again heeding the primeval urge to head (north) for the sun (surf and sand), this much accelerated by the pricing graphic and point 1 above of course

Mining - The mining investment bust is done, prices are firming, and royalties are again filling hungry government coffers

Tourism – Record inbound tourist numbers are providing another economic fillip for the state

Agriculture – We are doing better because prices are better but also because we’re getting better, droughts and all

It won’t be all beer and skittles however. The investment apartment hangover from the greatest binge in history will continue to adversely impact markets including those not really related, a situation banks are making worse by (justifiably probably but regrettably nonetheless) greatly restricting lending for all apartment purchases.

Has Sydney finally peaked? Well, people in Sydney seem to think so, so it probably has. We did see further upside last year for our southern cousins where many others didn’t but now we agree it’s fully topped and that 2018 will largely be a period of consolidation (probably preceded by a normal reverse dead cat bounce – the market bouncing back a little off the ceiling as it tends to do when reaching a new peak).

What of the talk Sydney could be in for a hard landing? We don’t think so unless it comes to pass the Chinese rug being pulled out from the market means more for Sydney than anyone thought it would or was reported (which would be rare) to be. Sydney was long overdue for a good run in the market after doing nothing in the noughties so their recent good run should have been expected, the only area of doubt being did the Chinese buy in then drive it beyond what otherwise might have been its cyclical peak. We don’t think so but we could well be wrong. We’ll know soon enough either way.

Melbourne on the other hand as the most Chinese influenced capital in the country may be a very different story, and this despite it surprisingly hanging tough to the surprise of many in 2017.

Such has been the Chinese influence on the fortunes of the Melbourne market, that their retreat from it could leave quite a void and expose it to quite a hard landing.

So far the cracks in the Melbourne market only appear hairline but with the Chinese money that drove it so hard fast drying up and the Victorian government struggling to deal with it, the cracks could open up considerably and quickly. If a fear driven flight from the Melbourne market takes hold, history shows it would take some stopping.

Adelaide rails run from the Melbourne boom has run its race because Melbourne as its key feeder market has but unlike Melbourne, as a ‘God’s Waiting Room’ capital (a distinction it shares with Hobart and to a lesser degree us), the level of any correction in Melbourne near term will not be felt to the same extent in Adelaide.

Perth’s price decline has slowed courtesy a bounce in commodity prices that appears to be holding. Like Brisbane, any recovery in their market should it get to that this year or next will be a ‘bottom up, inside out’ affair (i.e. bottom of the market upwards, inner city outwards) but unlike Brisbane be almost totally reliant on the resources sector holding up.

Hobart as the retirement capital of the nation (seriously why else would you go there other than to die on a budget) with its core feeder markets of Sydney and Melbourne having peaked has just had its best year of capital growth in decades at 13% yoy, almost as much as all other capitals (that had positive growth) combined, an inference that should continue albeit at a lesser pace whilesover the numbers bailing out at or around the top of the market in Sydney and Melbourne to go elsewhere to live cheaper stays high.

Canberra as the seat of government and with neither of the two principal parties willing to countenance (let alone put into effect) any semblance of cuts to the bloated public service (no it’s not another oxymoron – don’t go there) has had a good year and will have another as it benefits from cashed up inbound public service or public service allied transfers from the big two capitals.

Darwin performed worse than expected last year (and we expected it to perform pretty badly) to be the worst performing capital city in the country by some margin but may fare less poorly this year given firming commodity prices. Being such a small marketplace, Darwin is always hard to call, all you can predict with any certainty is its unpredictability.

AROUND THE GLOBE (select countries of interest | relevance)

The global property picture continues to become increasingly opaque (or we are looking too much into it).

Sullying the global property investment landscape particularly at present is governments ‘infatuation’ with the commercially inept but politically popular practise of supertaxing overseas investors which governments can because OI’s are such soft targets (and don’t get a vote). The trend is mind-numbingly short-sighted because whilst it may provide an immediate term mini fiscal and political fillip for governments dumb enough to try it, the severity and duration of the economic fallout from the pernicious practise outweighs any short term bounty. Beyond foreign investors taking their money elsewhere to where its more welcome is the broader damage to the reputation of the countries that impose the penalties. Once a country gets on the nose, it can stay that way for some time.

Given the number of countries choosing to wet their snouts in this latest dirty trough, where previously overseas investors would put most store in the economic fundamentals of the country they were looking to invest in, today almost equally important has become the question as to how likely the governments present and prospective of the preferred investment destination countries might be to introduce supertaxation or similar of overseas investors or simply add more layers to existing taxes as London has done so successfully recently much to its great discredit.

The practises gained popularity in over-regulated Europe, France taking the lead as early as the 1980’s with its raft of external investor taxes and other disincentives (remember the crazy squatter rule) that so threw investors at the time that today some 30+ years on, the odeur still lingers rankly.

Across the channel the UK’s most recent 3% supertax on purchases and rents (over and above already exorbitant general property purchasing and ownership premiums) that only applies to foreign investors has seen overseas ownership of London property drop by nearly 2/3 from 25% to just 11% in just the last few years.

Across the Atlantic Canada has introduced its own brand of like lunacy, their’s aimed squarely at mainland Chinese investors (again for the votes and short term cash windfall – they don’t care about the longer term damage as they don’t expect to still be in government to have to deal with it) where in Vancouver foreign investors now have to pay an extra $150,000 per $million more than Canadians to buy the same property. Now that’s a supertax!

The ploy has ‘worked so well’ it has seen sales turnover there plummet by an unprecedented 38% in just one year with prices on track to follow. The Canadian Goose that was laying so many golden eggs has been so well cooked by Ottawa that the government is getting less revenue post implementation of the super tax (due to the vastly shrunken volume) that what it was getting prior. Yes that was always predictable but only if your IQ is superior to your shoe size.

As Einstein is quoted as quoting ‘Only two things are infinite, man’s stupidity and the universe, and I’m not so sure about the latter’

We of course are becoming just as guilty and for similar short-sighted imperatives. Indeed we may have been guiltier earlier than many others to set the example for them to follow. Incredibly (certainly to the younger set) stamp duty used to actually be stamp duty, i.e. a cost set to defray the cost of stamping documents.

In has today become such an addictive cash cow behemoth and governments so hooked on it, they have no hope of ever weaning themselves off it, this despite them all seeing clearly the harm the drug is doing.

Enough of the stupidity of government. Peering into the turbid, select global property market waters in alphabetical order,CANADA (particularly out west) will continue to pay for its recent punitive property tax grab stupidity this year and beyond, where ‘jingle mail’, the act of handing back the keys and walking away from property has already arrived as a consequence; CHINA’s recent capital flow restriction inspired in country price spurt will lose momentum this year and depending on how Xi Xingping’s decision to stay in power indefinitely play out, could well see it go into reverse; helped somewhat by Brexit, FRANCE as one of the more stable countries of the EU (which speaks volumes of the rest) should continue its recovery from the substantial property price falls of the first half of the decade, GERMANY as the country that gets the most out of the EU alliance will also likely fare best from Brexit which should see property prices at least hold if not firm, particularly in Frankfurt as favourite to replace London as Europe’s financial capital; HONG KONG given it is easier for the mainland Chinese to repatriate money there should get to enjoy a good year (unless things calm down in China politically which is not likely); INDIA’s 5 year flatline market will continue flat; JAPAN will have another solid year despite ZPG; NZ will this year pay a high price for it’s ill-conceived (moronic) ban on foreign investors; the PIIGS overall will underperform thanks largely to the 25% depreciation in the Pound, brits in the past being key buyers; SINGAPOREshould continue to come out of its half decade long slump; SOUTH AFRICA will continue its strategic decline with no light at the end of any tunnel anywhere; SWITZERLAND‘s safe haven status will continue to lure nervous investors, particularly those from elsewhere in Europe; to the south last year’s broad price falls in the UAE will probably continue or even gather pace in tandem with rising regional tensions; the UK no surprise faces a very tough year(s) ahead; and finally the US will continue its long road back from it’s Sub Prime, Bear Stearns et al inspired lost decade.

KEY MARKET INFLUENCES CRYSTAL BALL

THE GOOD

~ The RBA rightly chooses not to follow the US lead in raising our benchmark interest rate

~ A dollar that if we don’t raise rates will fall further against the USD to make our property and visiting here cheaper

~ Staying current levels of housing affordability will greatly benefit the coming cyclical migration north to Brisbane

THE BAD

~ A federal government continuing bound, gagged and seemingly on life support

~ APRA seeing fit to flex its unqualified muscles again in the property market

THE UGLY

~ The Trade War between China and the US we flagged as likely last year and now formally underway widening

~ Australia getting clobbered for taking one side or the other, for not taking sides, or for trying to be a double agent

THE UNKNOWN (or Good Luck – Bad Luck – Who Knows File)

~ EU and UK beyond Brexit

~ China and the yuan beyond Xi Xinping’s deification

~ The end game of global 0% Interest Rates + Low to Negative Birth Rates + Money Printing + Runaway Debt

THE HOPE FILE

~ The great buyer migration north happens soon (this year)

~ Company taxes come down to where we can again compete globally

THE HOPE NOT FILE

~ An early federal election called here at home

~ The great buyer migration north stalls again

~ Banks call in their loans on investment apartments

THE WHAT WON’T HAPPEN THIS YEAR FILE

~ Genuine inflation and corresponding need for interest rate rises in Australia

CURVE BALLS

Trump (still) | Russia (always) | Investment Apartment Market Implosion

EXECUTIVE LEASING:

Brisbane’s quality residential leasing sector will firm this year for both houses and for apartments, though less so for the latter given it will be a little held back by the negative flow-on effects of the massive price discounting developers had adopted lower down the market in order to try and find tenants for their many unsold or unsettled apartments.

Expected to rebound particularly well after a number of years in the woods is the corporate leasing sector given burgeoning demand from a renewed tourism boom and a recovering resources sector.

Not dissimilar to what is happening in the sales sector, we expect the recovery to be pushed from the bottom up (in price) and from the inside out (from the CBD).

In tandem with the nascent recovery in Brisbane’s higher end property prices we can also expect that there will be a diminished availability of stock at the upper end of the leasing market as those people who previously leased when they couldn’t sell are again tempted to sell, an inference we expect to be most poignant across houses.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

THE FINAL WORD

‘LET’S HOPE AUSTRALIA DOESN’T FALL OFF CHINA’s BACK’

Like it or not, we now ride squarely on China’s back.

We need China more than we need anyone else and sadly, much more than they need us, we being only a market of 25 million people and less than 1/3 the size of their largest trading partner which it may surprise many to know, is Europe, and not the US.

Where it was once England, then the US, then Japan, then Asia collectively we depended upon for our ongoing prosperity, it is now unequivocally China.

And our dependence is broadranging, indeed increasingly almost universal across the many key sectors of our economy. The Chinese are today either our number 1 or at least 2 or 3 customer for our resources, our agriculture, foodstuffs, beverages, tourism, and latterly of course, our landed property of all descriptions.

Which makes the times we live in all the more interesting.

Whether or not he is in reality a vindictive man, indeed we think he is not which is why he succeeded in business, Trump the politician is right now desperate to land some punches from his many airswings and given the political climate, he thinks China might be his best sparring partner, with its (not) recent military expansions in the South China Sea the reason to pick the fight. We say not recent because they have had bases in the disputed islands for nearly 40 years.

If in trying to improve his image at home he lands a solid blow against the Chinese abroad, just how we can avoid becoming TKO’ed in the mix is worth giving some thought to.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Wishing you all the best in 2018 and beyond

Best Regards,

John Johnston

CEO